Motor Vehicle Tax

Type of Taxes/ Fee:

Rate Of New Registration Luxury Tax Rates of Transfer Rates of Token Tax Motor Car Rates of Other Post Transactions Rates of Security Featured Items Rate of Capital Value Tax (CVT) Rates of Withholding Tax - (One Time at Registration on Local Cars) Rates of Motor Tax on Commercial Vehicles Rates of Income Tax Rebate in Token Tax

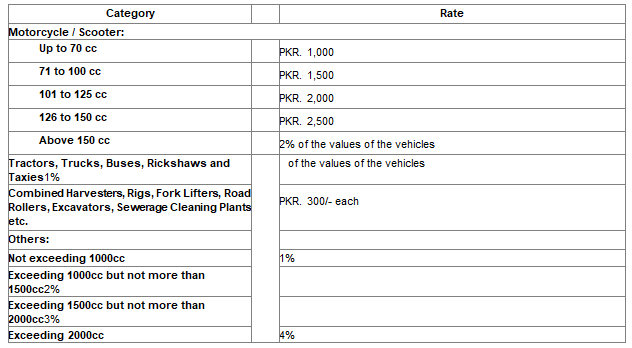

New Registration: :

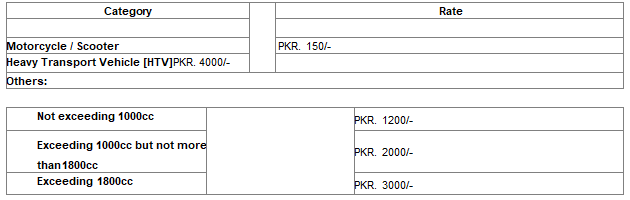

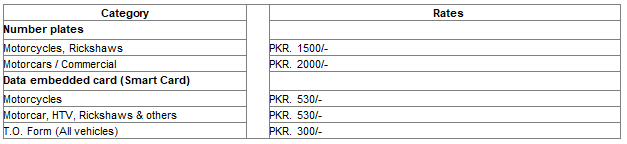

Rates of Transfer Fee:

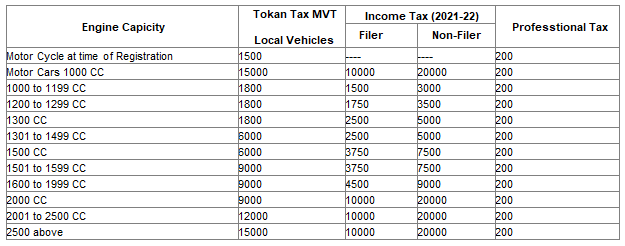

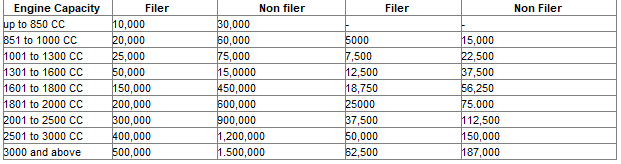

Rates of Token tax, Income Tax, Professional Tax for Motor Car:

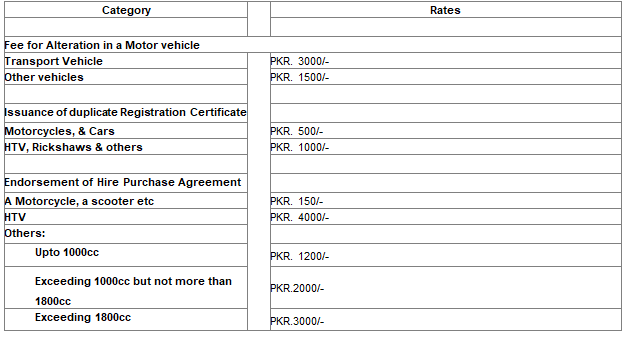

Rates of Other Post transaction:

Rates of Security Feature Items:

Capital Value Tax (CVT) applies on (Every Tarnsfer) and in NR (if not lready paid) with effect from 1st July 2022:

1. Applied on all Category of vehicle 2. CC > 1300

3 Period - 5 years from 1-July of proceeding financial year of date of registration. (after 6 years it will be zero)

4 Rate of tax 1%of the value of the vehicle

5 10% depreciation in value of the vehicle in every year will be applied

Rates of With Holding Tax with effect from 1st July 2022:

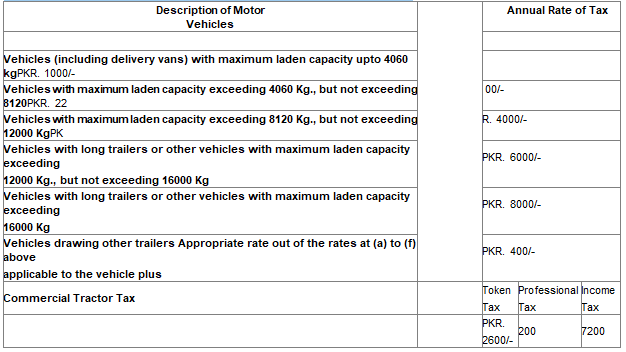

Rates of Motor Tax on Commercial Vehicles:

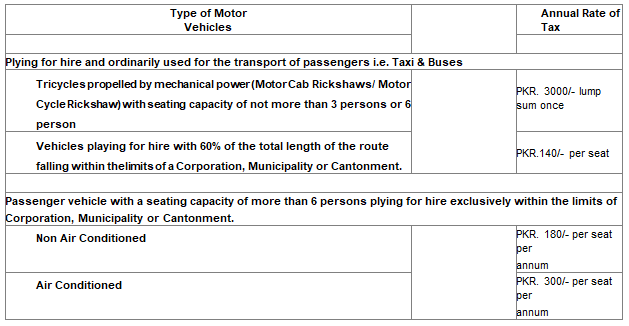

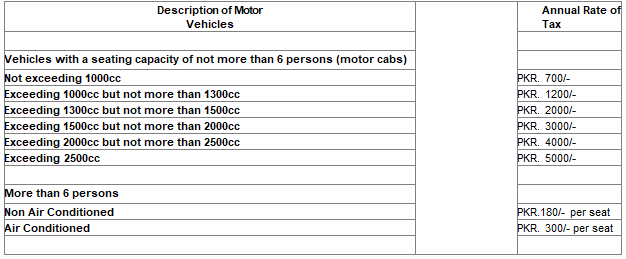

Rates of Motor Tax on Commercial Passenger Vehicles:

Rates of Motor Tax on Commercial Motor Cabs:

Note seating capacity for the purpose of this clause shall not include the seats meant for driver and conductor.

Note seating capacity for the purpose of this clause shall not include the seats meant for driver and conductor.

Rates of Motor Tax on Private Vehicles

(Seating capacity of more than 6 persons)

Rebate in Token Tax:

A rebate equal to 10% of the amount of annual token tax is allowed if the tax for the whole year is paid on or before 31st of September of the financial year

5% more special discount for payment through E-Pay

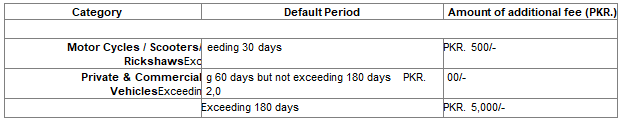

Addtional Fee on New Registration

Provided further that in case a motor vehicle is not registered within prescribed period after import, sale, clearance or release of vehicle from the custom authorities or local manufacturer, the following additional fee shall be paid

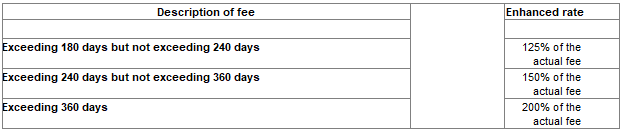

In case of registration of tractors exclusively used for agricultural purpose, the fee shall be paid at the following enhanced rate

In case of registration of tractors exclusively used for agricultural purpose, the fee shall be paid at the following enhanced rate

Addtional Fee on Token Tax

Addtional Fee on Token Tax

If Token Tax is paid up until the 30th, there will be no penalty. After September 30th, a penalty of 20% per month, not to exceed 100%, will be assessed.

The Motor Registration Authority will collect any unpaid token taxes in the case of rickshaws and taxis and issue a penalty slip in this regard.

Commercial and tied-up cars must pay the tax in advance within the first month of each quarter of the fiscal year, i.e., before July 31 for the first quarter, October 31 for the second quarter, January 31 for the third quarter, and April 30 for the fourth quarter.